In business and trade, pricing plays a very important role in decision-making, profit calculation, and transparency. Every product passes through multiple pricing stages before reaching the final buyer. Understanding basic pricing terms helps businesses manage costs, set correct selling prices, and maintain accurate financial records. Two of the most commonly used terms are cost price and invoice price.

Common Confusion Between Cost Price and Invoice Price

Many buyers, sellers, and traders often confuse cost price with invoice price. Some assume both are the same, while others fail to understand what additional charges are included in an invoice. This confusion can lead to incorrect profit calculations, disputes between buyers and sellers, and accounting errors.

Who Should Know the Difference

Understanding the difference between cost price and invoice price is important for:

- Buyers, to know what they are paying for

- Sellers and traders, to calculate profit margins

- Accountants, to maintain accurate books of accounts

- Business owners, to make better pricing and tax decisions

What Is Cost Price?

Cost price is the total amount spent by a seller to produce or purchase a product before selling it. It represents the actual cost incurred to bring the product to a sale-ready condition. Cost price does not include profit or selling taxes charged to customers.

Components Included in Cost Price

Raw Materials

This includes the cost of basic materials used to manufacture the product, such as metals, grains, fabrics, chemicals, or components purchased from suppliers.

Manufacturing or Procurement Cost

For manufacturers, this includes machinery usage, factory expenses, and production costs. For traders, it includes the purchase price paid to suppliers or wholesalers.

Labor and Overhead Expenses

Labor costs include wages and salaries of workers involved in production or handling. Overhead expenses include electricity, rent, maintenance, packaging, and storage costs related to the product.

Example of Cost Price Calculation

Suppose a trader purchases goods at ?800 per unit. Additional expenses include:

- Transportation: Rs 50

- Packaging: Rs 30

- Labor and storage: Rs 20

Total Cost Price = Rs 800 + Rs 50 + Rs 30 + Rs 20 = Rs 900 per unit

Why Cost Price Matters for Sellers

Cost price helps sellers:

- Decide the minimum selling price

- Calculate profit or loss accurately

- Control unnecessary expenses

- Improve pricing strategies and competitiveness

Without knowing the correct cost price, a seller may unknowingly sell products at a loss.

What Is Invoice Price?

Invoice price is the final amount charged to the buyer and mentioned on the invoice. It includes the selling price of the product along with taxes, transportation charges, and other applicable costs. Invoice price is what the buyer actually pays.

What an Invoice Includes

Product Price

This is the selling price of the product, which includes the seller’s profit margin added to the cost price.

Taxes (GST/VAT)

Government taxes such as GST or VAT are added to the product price as per applicable tax laws. These taxes are mandatory and clearly mentioned on the invoice.

Transportation and Handling Charges

If the seller charges for delivery, freight, loading, or handling, these costs are added to the invoice price.

Discounts (If Any)

Trade discounts, bulk purchase discounts, or promotional offers are deducted from the total amount and shown clearly on the invoice.

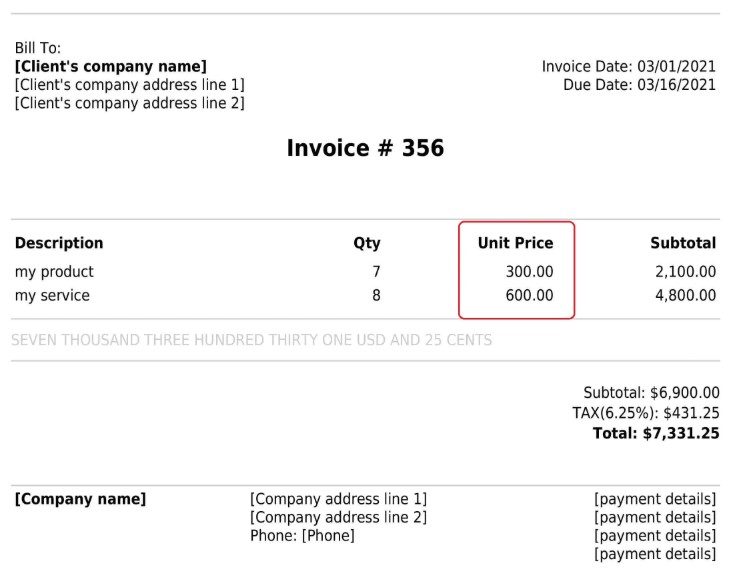

Example of Invoice Price

Continuing the previous example:

- Cost price: Rs 900

- Seller’s profit: Rs 100

- Product selling price: Rs 1,000

- GST @ 18%: Rs 180

- Transportation charges: Rs 50

Invoice Price = Rs 1,000 + Rs 180 + Rs 50 = Rs 1,230

Importance of Invoice Price in Billing and Accounting

Invoice price is important because it:

- Acts as a legal sales document

- Helps buyers understand price breakdown

- Is used for tax filing and compliance

- Ensures transparency in business transactions

- Helps accountants record accurate sales and revenue

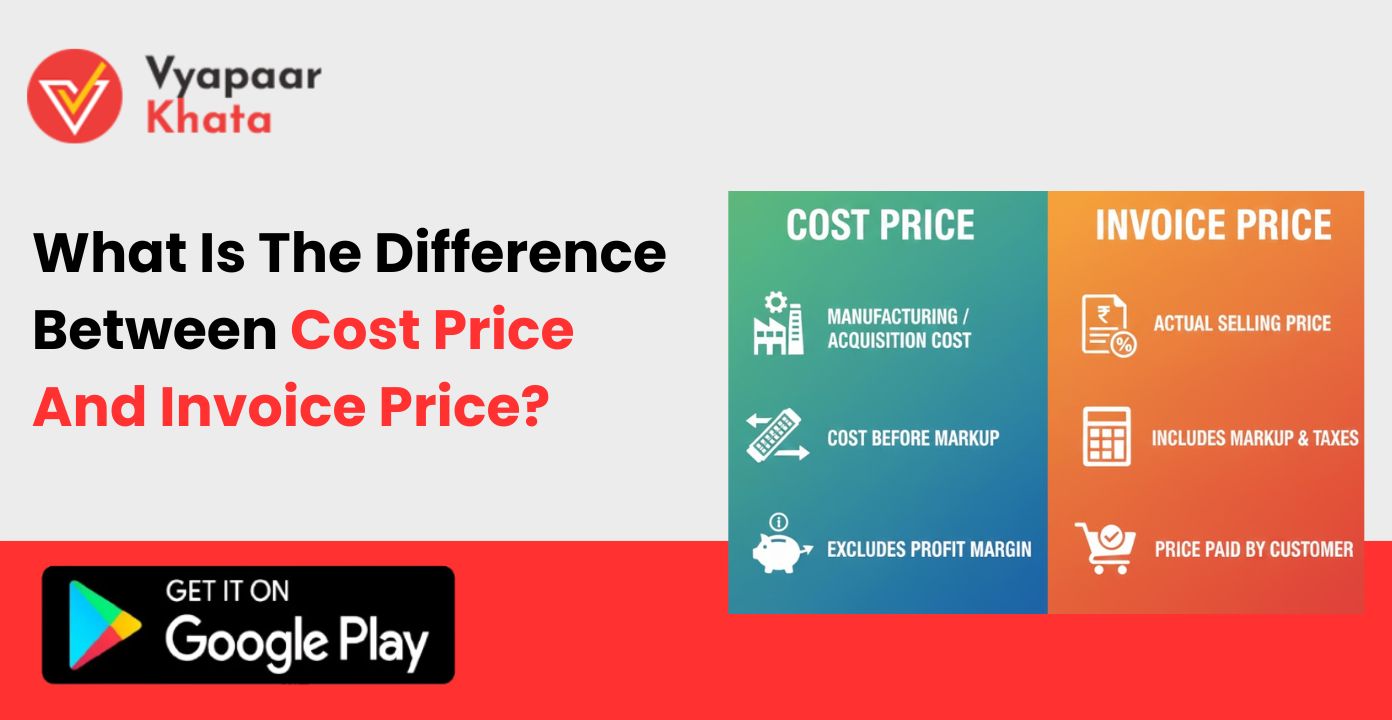

Difference Between Cost Price and Invoice Price

| Basis | Cost Price | Invoice Price |

|---|---|---|

| Meaning | Actual expense incurred to produce or purchase a product | Final amount charged to the buyer |

| Includes | Raw materials, labor, overheads, procurement cost | Product price, taxes, transport, discounts |

| Profit Included | No | Yes |

| Taxes Included | No | Yes (GST/VAT) |

| Used By | Sellers, manufacturers, traders | Buyers, sellers, accountants |

| Purpose | To calculate profit or loss | For billing, payment, and tax records |

| Visibility | Internal business calculation | Shown on official invoice |

Key Differences Explained in Simple Terms

The cost price is what a seller spends to get the product ready for sale. It is an internal figure and is usually not shared with buyers.

The invoice price is what the buyer sees and pays. It includes the seller’s profit, government taxes, and other additional charges.

In short:

- Cost Price = Seller’s expense

- Invoice Price = Buyer’s payable amount

Why Understanding This Difference Is Important in Business

Understanding the difference between cost price and invoice price helps businesses:

- Avoid incorrect profit calculations

- Maintain transparent pricing

- Prevent disputes with buyers

- Ensure correct GST filing

- Improve negotiation and pricing strategies

For buyers, it helps them understand whether they are paying a fair price and what extra charges are included.

Real-Life Business Example

A wholesaler buys rice from a mill at Rs 2,500 per bag.

Additional costs:

- Transport: Rs 150

- Storage and handling: Rs 100

Cost Price = Rs 2,750

The wholesaler adds:

- Profit: Rs 250

- GST @ 5% on ?3,000 = Rs 150

Invoice Price = ?3,150

Here:

- Seller’s profit = Rs 250

- Buyer pays = Rs 3,150

Common Mistakes Businesses Make

- Treating invoice price as cost price

- Forgetting to add overhead expenses to cost price

- Not separating taxes from product value

- Ignoring transportation costs while pricing

- Calculating profit without accurate cost data

Avoiding these mistakes improves financial control and pricing accuracy.

Cost Price vs Invoice Price

1. Is cost price the same as purchase price?

No. Purchase price is part of cost price. Cost price also includes transport, labor, and overhead expenses.

2. Does invoice price always include tax?

Yes, invoice price usually includes applicable taxes like GST or VAT.

3. Can invoice price be lower than cost price?

Yes, in cases of discounts, clearance sales, or losses.

4. Is profit included in cost price?

No. Profit is added to cost price to decide the selling price.

5. Why is invoice price important for GST filing?

GST is calculated based on invoice value, making it essential for tax compliance.

6. Who prepares the invoice price?

The seller prepares the invoice and mentions the invoice price.

7. Can transportation be excluded from invoice price?

Yes, if transport is free or borne by the buyer separately.

8. Do buyers need to know the cost price?

No, cost price is internal, but knowing it helps in negotiation.

9. Which price is recorded in accounting books?

Invoice price is recorded for sales; cost price is recorded for expense tracking.

10. Why do traders focus more on cost price?

Because accurate cost price ensures correct profit margins.

Understanding the difference between cost price and invoice price is essential for smooth business operations. Cost price helps sellers manage expenses and profits, while invoice price ensures transparent billing and legal compliance. When both buyers and sellers clearly understand these terms, it leads to better trust, accurate accounting, and profitable trade.